Seattle’s financial institutions face strict security requirements that extend beyond digital systems to physical facility management. Bank cleaning protocols must align with federal, state, and local compliance standards.

We at Bumble Bee Cleaning Services understand these specialized requirements. Professional cleaning services play a vital role in maintaining security standards while protecting sensitive financial data and documents.

What Security Rules Apply to Seattle Banks

Seattle financial institutions operate under a complex regulatory framework that demands strict adherence to federal, state, and local security standards. The Federal Financial Institutions Examination Council sets the foundation with comprehensive guidelines that require banks to maintain robust physical security measures alongside their digital protections.

Federal Compliance Framework

The FFIEC establishes specific protocols for document handling, access control, and facility maintenance that directly impact cleaning operations. These federal standards mandate comprehensive security measures that extend beyond digital systems to physical facility management. Banks must meet evolving regulatory and cybersecurity expectations through proper compliance programs, with underlying physical security requirements remaining constant and non-negotiable.

Financial institutions must align their practices with the NIST Cybersecurity Framework 2.0. This framework provides guidance to industry, government agencies, and other organizations to manage cybersecurity risks. The Cybersecurity and Infrastructure Security Agency released Cross-Sector Cybersecurity Performance Goals in 2023 to aid organizations in managing cybersecurity risks, with financial sector-specific goals expected in late 2025.

Washington State Banking Requirements

Washington State Department of Financial Institutions adds another layer of compliance through specific mandates outlined in Washington Administrative Code sections 208-620, 208-660, 208-680, and 208-690. These regulations require financial institutions to implement comprehensive Information Security Programs that extend to physical facility management.

The state emphasizes maintaining confidentiality, integrity, and availability of consumer information through proper facility maintenance and cleaning protocols. Washington’s requirements specifically address business resumption plans and data breach notification processes. Regular audits of information security programs can significantly reduce operational and reputational risk (making specialized cleaning partners who document their procedures invaluable for meeting state examination requirements).

Local Authority Compliance Standards

Seattle’s local banking authorities work with federal and state regulators to examine financial institutions based on risk assessments and operational complexity. Large institutions face annual examinations while smaller banks may undergo review every 18 months, with cleaning and facility maintenance records forming part of these evaluations.

The examination process focuses on safety and soundness, compliance, risk management, and internal controls – all areas where proper facility cleaning plays a supporting role. Professional cleaning services must understand these examination cycles and maintain documentation that supports institutional compliance efforts during regulatory reviews.

These regulatory requirements create specific cleaning challenges that demand specialized knowledge and protocols to maintain compliance across all operational areas.

How Do Banks Secure Physical Access and Documents

Financial institutions implement multi-layered physical security protocols that protect against unauthorized access while maintaining operational efficiency. Access control systems require strategic placement of card readers, biometric scanners, and surveillance equipment throughout facilities. The Federal Reserve’s 2023 Financial Institution Risk Officer Survey identified fraud as a top operational concern, which makes robust physical security measures non-negotiable for banks.

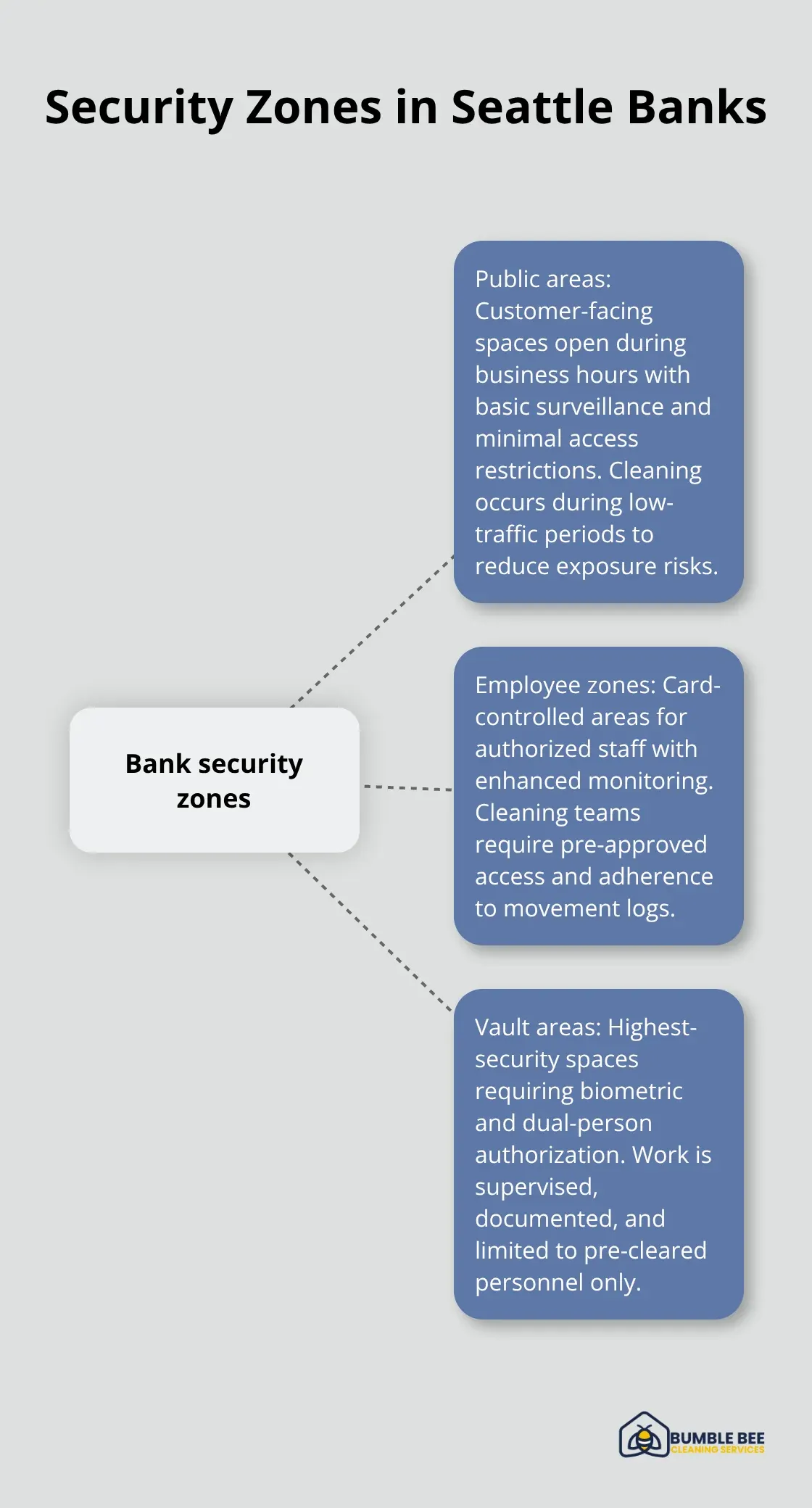

Security Zone Classifications

Banks establish three distinct security zones: public areas, restricted employee zones, and high-security vault areas. Each zone demands different access credentials and monitoring protocols. Public areas allow customer access during business hours with basic surveillance coverage. Employee zones restrict access to authorized personnel with card-based entry systems and enhanced monitoring capabilities.

High-security vault areas require biometric authentication, dual-person authorization, and continuous surveillance with motion detection systems. Professional cleaning teams must obtain zone-specific clearances and follow strict protocols when they move between security levels.

Surveillance and Access Monitoring

Surveillance systems provide continuous coverage with minimum 30-day storage capabilities throughout all facility areas. Access logs require real-time monitoring and monthly audits to track personnel movement patterns. Security cameras must capture high-resolution footage in all zones, with backup power systems that maintain operation during outages.

Banks conduct regular access reviews to verify employee permissions and identify potential security gaps. Documentation of all activities becomes part of the security audit trail (including cleaning operations and maintenance work performed in restricted areas).

Document Protection Protocols

Confidential documents require secure handling protocols that extend beyond normal procedures. The LexisNexis 2023 True Cost of Fraud Study revealed that fraud costs in financial services reach $4.41 times the value of lost transactions, which makes document security paramount for all operations.

Banks implement clean desk policies, secure document storage systems, and controlled disposal methods for sensitive materials. Staff must secure all documents in locked cabinets or safes before leaving workstations. Temporary document storage requires locked containers with restricted access logs.

Secure Disposal and Emergency Response

Shredding protocols must meet federal standards, with cross-cut shredders mandatory for documents that contain personal financial information. Banks maintain detailed logs of all document destruction activities, including witness signatures and disposal certificates. Cleaning staff require background checks, specialized training, and supervised access to areas with confidential information.

Emergency response procedures address potential security breaches during all operations, including immediate containment protocols and incident reporting requirements. These security measures create specific maintenance challenges that demand specialized knowledge and protocols to maintain compliance across all operational areas.

What Cleaning Standards Do Banks Require

Professional cleaning services for financial institutions must operate within security frameworks that go far beyond standard commercial cleaning protocols. The 2023 Identity Theft Resource Center report showed a 78% increase in data breaches that affected financial services compared to 2022, which makes specialized procedures non-negotiable for compliance. Banks require teams with security clearances, background checks, and detailed knowledge of document protocols to maintain regulatory compliance.

Security Zone Access Requirements

High-security zones demand specialized approaches that protect confidential information while maintaining cleanliness standards. Staff must complete facility-specific training that covers access procedures, surveillance protocols, and emergency response requirements before they enter restricted areas. Bank vault cleaning requires two-person teams with biometric clearance and continuous supervision throughout the process.

Staff must use approved products that won’t damage security equipment or leave residues that could interfere with biometric scanners or card readers. Documentation of all activities becomes part of the bank’s security audit trail, with timestamps and staff signatures required for each zone entry.

Document Handling Protocols

Banks generate massive amounts of confidential documents that require secure handling during operations. Employee mistakes cause 88% of data breach incidents, which makes proper document protocols absolutely vital for staff. Teams must never move or handle documents without direct supervision from bank personnel.

All document shredding must use cross-cut shredders that meet federal standards, with staff responsible for emptying shredder bins into locked disposal containers. Trash removal requires chain-of-custody documentation and witnessed disposal at approved facilities.

Maintenance Schedule Compliance

Regular maintenance schedules must align with bank examination cycles, as regulatory reviews include facility cleanliness and maintenance records as part of compliance assessments. Professional companies maintain detailed logs that track which areas were cleaned, what products were used, and which staff members performed the work (creating an audit trail that supports regulatory compliance).

These specialized requirements demand expertise that goes beyond traditional commercial cleaning services.

Final Thoughts

Seattle financial institutions must navigate complex federal, state, and local security requirements that extend far beyond digital systems. The FFIEC framework, Washington State regulations, and local banking authority guidelines create demanding standards for physical facility management. Bank cleaning operations require specialized knowledge of access control protocols, document handling procedures, and surveillance system maintenance.

Professional compliance support becomes indispensable when institutions manage these intricate requirements. The 78% increase in financial services data breaches highlights why banks cannot afford security gaps in their facility management. Specialized teams must understand security zone classifications, maintain proper documentation, and follow strict protocols for confidential document handling.

We at Bumble Bee Cleaning Services bring experience with professional certifications to help financial institutions maintain compliance (our team understands the unique challenges of bank cleaning while providing the documentation and protocols that regulatory examinations require). Financial institutions ready to strengthen their compliance framework should partner with experienced commercial cleaning professionals who understand regulatory requirements. The investment in specialized facility management protects against costly compliance failures while maintaining the security standards that customers and regulators expect.