Tenant screening is one of the most powerful tools you have as a Seattle property manager. The difference between a smooth rental experience and a costly nightmare often comes down to how thoroughly you vet your applicants.

At Bumble Bee Cleaning Services, we’ve seen firsthand how the right screening process protects your property and your bottom line. This guide walks you through the methods that work, the mistakes to avoid, and how to build a screening system that actually saves you money.

Why Screening Protects Your Seattle Property

Financial Protection Through Proper Vetting

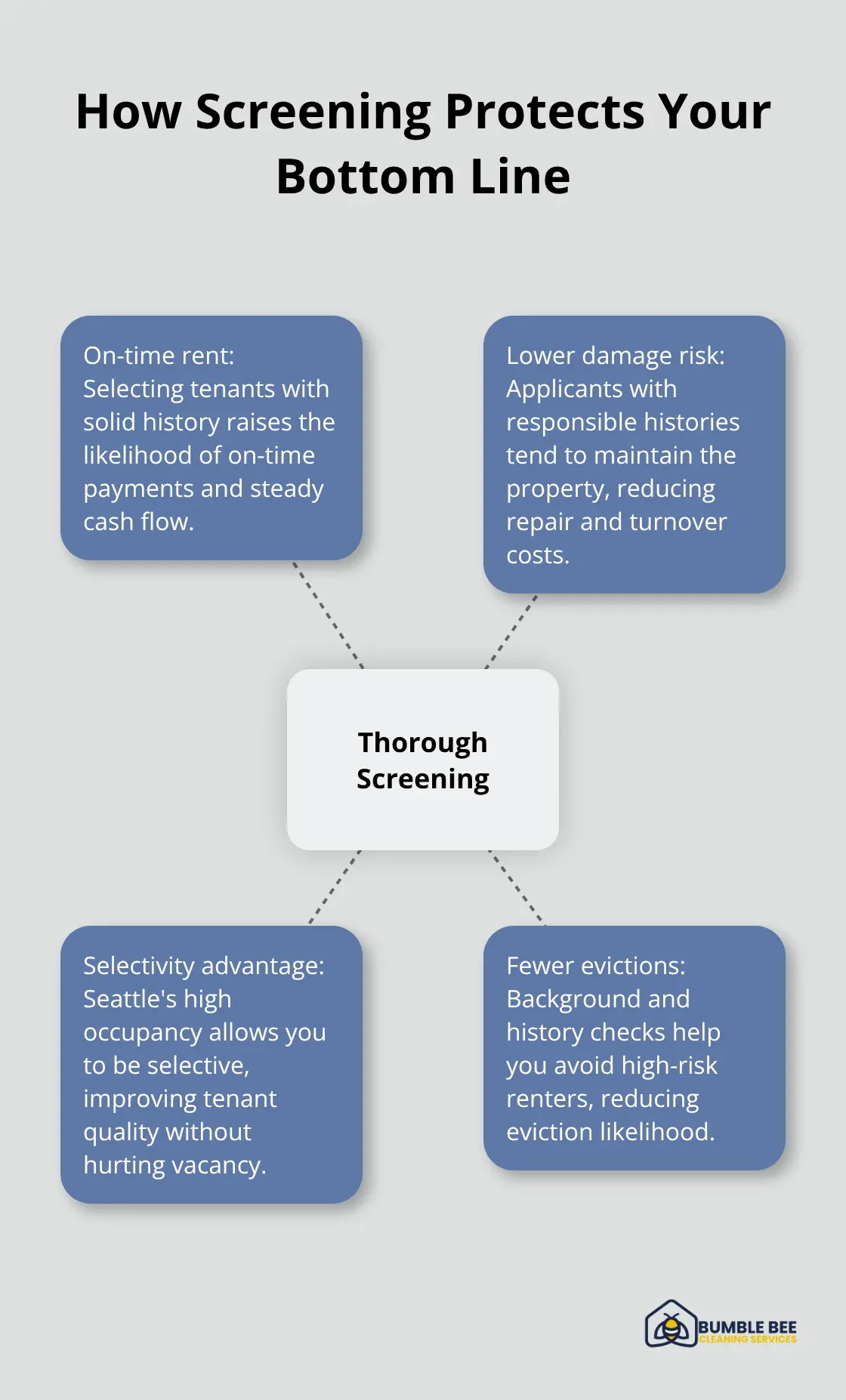

Tenant screening directly impacts your wallet in ways that go far beyond a single bad rental decision. When you screen properly, you make a data-driven choice about who lives in your property, and that choice determines whether you’ll spend the next 12 months collecting rent on time or fighting an eviction and managing property damage. Seattle’s rental market is competitive, with occupancy rates remaining high, which means you can afford to be selective. A tenant with solid rental history and manageable debt pays rent on time and maintains the property far better than one you’ve barely vetted.

The cost of a single eviction in Washington reaches $3,000 to $5,000 when you factor in legal fees, court costs, and lost rental income during the process. Property damage compounds this problem-carpet replacement, wall repairs, and deep cleaning after a problematic tenant moves out can cost thousands more. When you run background checks and verify employment history before signing a lease, you filter out applicants with prior evictions or a pattern of late payments. This isn’t guesswork; it’s protection.

Liability and Legal Compliance

Poor screening creates liability issues that follow you long after a tenant moves out. A tenant with an undisclosed criminal history who later commits a crime on your property could expose you to negligent screening claims. Reference checks with previous landlords take 15 minutes but reveal whether an applicant damaged units or violated lease terms. Income verification-requesting recent payslips and confirming employment-takes another 20 minutes and shows whether a tenant can actually afford your rent.

Seattle’s strong tech-professional demographic means many applicants have stable employment, but verifying it costs nothing and eliminates the risk of renting to someone who misrepresented their financial situation. Fair Housing compliance also depends on consistent, documented screening. RCW 59.18.257 requires you to provide written screening criteria before collecting applications and to issue an Adverse Action Notice if you deny based on screening results. This documentation protects you legally while treating all applicants fairly.

Building a Defensible Screening Record

When you screen thoroughly and document every step, you build a defensible record that demonstrates you made rental decisions based on objective criteria, not bias. This documentation becomes essential if an applicant challenges your decision or if a tenant later causes problems. The screening process itself-when properly executed and recorded-serves as your legal shield. Each verification you conduct, each reference you check, and each piece of information you collect strengthens your position and shows that you acted responsibly.

The next section covers the specific methods and tools that make this protection possible.

Building Your Screening Arsenal

Credit Reports and Background Checks

Credit reports and background checks form the foundation of any serious screening process, and skipping either one leaves you vulnerable. A credit report reveals payment history, outstanding debts, and bankruptcy records that signal whether an applicant can actually afford your rent. You run this check with written permission from the applicant, and you’ll see their credit score, any collections accounts, and past delinquencies. Background checks uncover eviction history, which is your strongest predictor of future problems. A recent eviction is a massive red flag that should disqualify most applicants immediately. When you combine credit data with eviction records, you’re looking at concrete evidence of financial reliability, not guesswork.

Employment and Income Verification

Employment and income verification takes minimal effort but eliminates a huge source of problems. You call the employer directly to confirm the applicant’s job title, tenure, and salary rather than relying on payslips that could be forged. You request recent pay stubs covering the last two months and verify the amount matches what they claimed on the application.

For Seattle’s tech professionals, this verification is straightforward since companies maintain clear HR records. Income should be at least three times the monthly rent to ensure the tenant can cover rent plus other living expenses without financial strain. If you skip this step, you’re essentially hoping someone who can’t afford the rent will somehow pay it anyway.

Reference Checks with Previous Landlords

Reference checks with previous landlords provide irreplaceable insight into how an applicant actually treats a property and handles lease obligations. You contact their last two landlords and ask directly about rent payment timeliness, property damage, lease violations, and whether they’d rent to this person again. Most landlords answer honestly because they want problem tenants off their hands. This 15-minute conversation often reveals patterns that applications hide. A tenant who paid rent late at their last two places will likely do the same with you. Someone who left a unit damaged will damage yours too.

You document every reference call in writing, including the date, who you spoke with, and what they said. This documentation protects you legally and creates an objective record you can reference if the applicant later disputes your decision. Seattle’s high occupancy rates mean you can afford to move on from applicants with weak references. A solid applicant will have at least one previous landlord willing to vouch for them. If you can’t reach references or they’re evasive, that’s a sign to keep looking.

Putting It All Together

These three screening methods work best when you use them together as a complete system. A strong credit score combined with stable employment and positive landlord references creates a clear picture of a reliable tenant. Conversely, weak performance in any single area (poor credit, employment gaps, or negative references) warrants serious caution. The screening tools you’ve assembled now give you the data you need to make confident decisions, but only if you avoid the common mistakes that undermine even the best screening systems.

Common Screening Mistakes Seattle Property Managers Make

Incomplete Information Undermines Your Decisions

Most Seattle property managers sabotage their own screening by collecting incomplete information and then acting on it anyway. You ask for employment verification but never actually call the employer to confirm the details, so you miss that the applicant lost their job two months ago. You request references but accept a phone number that turns out to be a friend rather than a previous landlord. You pull a credit report but never ask about the collections account sitting on it, so you don’t learn that it was a medical debt the applicant actively disputes. Incomplete information undermines your decisions, but it gives you false confidence in your decision.

The fix is brutally simple: verify everything in writing or through direct contact. Call employers and request to speak with HR, not the applicant’s supervisor who might be the applicant’s friend. Contact previous landlords directly using contact information you find independently, not phone numbers the applicant provides. Request written explanations for any negative items on credit or background reports before you make your final decision. This takes an extra hour per applicant, but it eliminates the candidates who were banking on you not digging deeper.

Red Flags That You Cannot Ignore

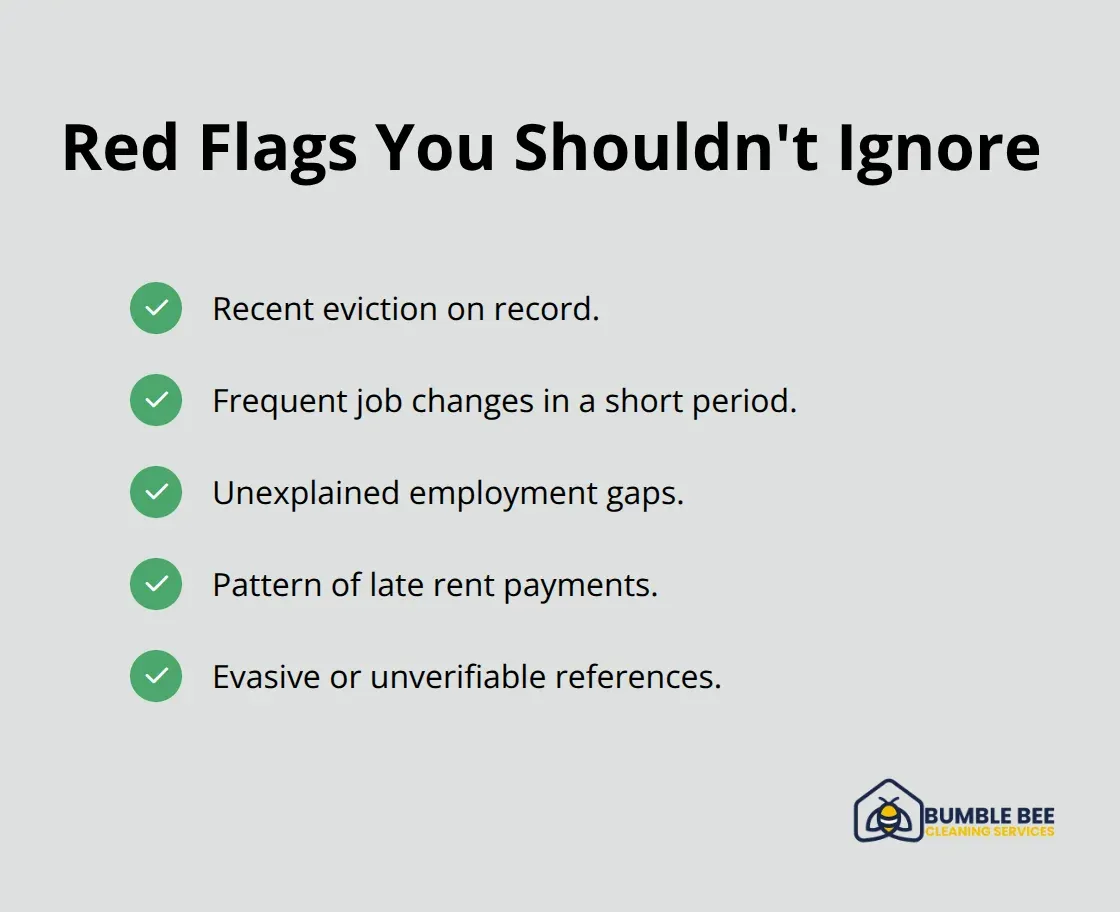

The second mistake is ignoring red flags that sit right in front of you. A recent eviction appears on the background check, and you tell yourself the applicant has learned their lesson. An employment history shows four job changes in two years, and you assume they’re just ambitious. A reference check reveals late rent payments at the previous property, and you rationalize that they’ve improved since then.

Seattle’s tight rental market makes you feel pressure to approve someone rather than keep the unit vacant, so you override your instincts and ignore what the data tells you.

A recent eviction is your strongest predictor of future eviction risk, and no amount of explanation changes that statistical reality. If you ignore this red flag, you’re gambling with thousands of dollars in potential losses. Employment gaps, frequent job changes, and patterns of late payment all signal future problems. These aren’t character flaws you can overlook-they’re concrete patterns that repeat themselves. When the data shows a problem, your job is to act on it, not rationalize it away.

Documentation Protects You Legally

The third mistake is failing to document the screening process properly, which leaves you vulnerable legally and makes it impossible to defend your decisions later. You conduct a reference call but don’t write down what the landlord said, so when the applicant challenges your denial, you can’t prove what you learned. You issue an Adverse Action Notice as required by RCW 59.18.257, but you don’t keep a copy in your file, so you have no evidence of compliance if a dispute arises. You approve one applicant and deny another with similar profiles, and without documented criteria, you can’t explain why, which opens you to fair housing claims.

Document everything: write down the date and outcome of every background check, the name and phone number of every reference you contact, what they told you, and the specific reason you approved or denied each applicant. This documentation takes 10 minutes per applicant and protects you far more effectively than any screening tool ever could. When you have a clear written record, you can defend your decisions with confidence and demonstrate that you applied consistent standards to all applicants.

Final Thoughts

Tenant screening protects your property and your income in ways that compound over time. Tenants with solid screening profiles stay longer, pay on time, and maintain your property better, which means predictable income, lower turnover costs, and fewer emergency repairs. You avoid the stress of evictions and the financial drain of extended vacancies while your property appreciates because reliable tenants treat it well.

Start stronger screening practices by collecting complete information, verifying everything independently, and documenting your process. Apply the same standards to every applicant, act on red flags rather than rationalize them away, and make tenant screening a non-negotiable part of your leasing process. This consistency protects you legally while ensuring you select tenants who can actually afford your rent and will respect your property.

When a tenant moves out, the condition of your unit determines your next vacancy costs. Professional turnover cleaning from Bumble Bee Cleaning Services removes the damage and wear that problem tenants leave behind, preparing your property for the next qualified applicant.